Capri Global Capital Ltd announces Stock Split and 1:1 bonus

For Q3FY24, Net Profit rise 81.7% Y-o-Y to Rs. 68 crore, AUM rise 54.4% to Rs. 13,362.1 crore Mumbai (Maharashtra) [India], February 7: Board of directors of Capri Global Capital Ltd (CGCL), a diversifiedNon-Banking Financial Company (NBFC) with a presence across diverse segments like MSME, Affordable Housing, Construction Finance segments among others has approved stock [...]

For Q3FY24, Net Profit rise 81.7% Y-o-Y to Rs. 68 crore, AUM rise 54.4% to Rs. 13,362.1 crore

Mumbai (Maharashtra) [India], February 7: Board of directors of Capri Global Capital Ltd (CGCL), a diversifiedNon-Banking Financial Company (NBFC) with a presence across diverse segments like MSME, Affordable Housing, Construction Finance segments among others has approved stock split and 1:1 bonus issue. The company board also approved issuance of Non-Convertible Debentures through Public issue/private placement for an amount up to Rs. 500 crore in tranches.

The Board of directors at its meeting held on January 27 has approved sub-division of one equity share of the face value of Rs. 2 each fully paid-up into two equity shares of the face value of Re. 1 each fully paid-up. Company board also approved 1:1 bonus issue i.e one new fully paid-up bonus equity share of face value of Re.1 each for every one fully paid-up equity share of face value of Re.1. Company has fixed the record date as Tuesday, March 5, 2024, for the stock split and bonus, subject to the approval of shareholders at the ensuing Extra-ordinary General Meeting of the Company scheduled to be held on Thursday, February 22, 2024.

For the Q3FY24 company has reported net profit of Rs. 68 crore, rise of 81.7% Y-o-Y from the net profit of Rs. 37.4 crore reported in Q3FY23. Asset under management of the company rise 54.4% to Rs. 13,362.1 crore as on Q3FY24, rise of 54.4% Y-o-Y from Rs. 8,654.5 crore in Q3FY23. Company has inducted Mr. L V Prabhakar, Mr. Shishir Priyadarshi, and Ms. Nupur Mukherjee as additional independent directors on its Board of Directors subject to shareholder approval.

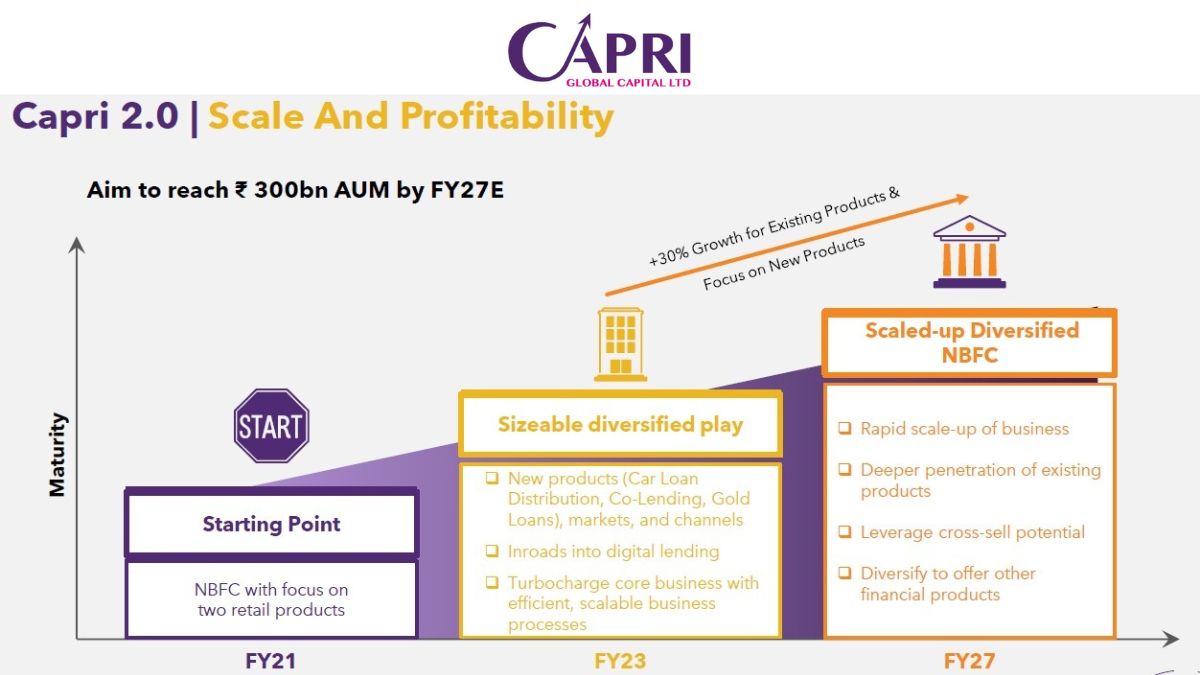

Capri Global is a diversified Non-Banking Financial Company (NBFC) with a presence across diverse and high growth segments like MSME, Affordable Housing, Construction Finance segments, and Car Loan distribution. Company also forayed into Gold Loans in Aug 22. Company is promoted by first generation entrepreneur, Mr. Rajesh Sharma and listed on BSE and NSE. With 917 branches in 14 states & UTs across North and West India and over 10,150 employees, company has reported AUM of Rs. 124 billion in Q2FY24. Promoter Group holds 69.89% stake in the company as on 31st Dec 2023. Going forward company is targeting AUM of Rs. 300 billion and earning target of mid-teen ROE over medium term with a strong focus on the business segments including Gold Loan, Affordable Housing and MSME loans.

Highlights:-

- Company plans to develop an insurance platform to maximize the Corporate Agency License From IRDAI

- Company has emerged as the Most Consistent Wealth Creator in the 28th Annual Wealth Creation Study Report (2018-2023) by Motilal Oswal

- During 2018-2023, company has reported robust CAGR of 26% in Net Profit and 33% in Sales.

- Company has outperformed the BSE Sensex in all the last 5 years during 2018-2023, and has the highest price CAGR of 50%.

- Company is targeting to reach Rs. 300 billion AUM by FY27 to be driven by 30% growth from existing products and focus on new products.

On 16th January 2024, company received a composite Corporate Agency license from the Insurance Regulatory and Development Authority of India (IRDAI) in December 2023 to distribute life, general, and health insurance products.

Company has also emerged as the Most Consistent Wealth Creator in the 28th Annual Wealth Creation Study Report (2018-2023) released by Motilal Oswal. It has outperformed the BSE Sensex in all the last 5 years, and has the highest price CAGR of 50%. It is also among the fastest wealth creators in the period. During the period of 2018-2023, company has reported robust CAGR of 26% in Net Profit and 33% in Sales. With the excellent consistent growth in the financials, share price of the company went up by 7.6 times during 2018-2023.

In the insurance business foray, company is planning to leverage technology to revolutionize the way insurance products and services are delivered to customers. The Company is planning to use data analytics, artificial intelligence, and blockchain to deliver insurance solutions. This will enable CGCL to automate claims processing and customer support services, thereby reducing the cost of operations while improving customer satisfaction. Hence, the key goal of the Insurtech platform will be to create an ecosystem of insurers who can offer coverage in a more affordable, customer-friendly way. This in turn will assist the Company to immensely contribute to the ‘Insuring India by 2047’ mission of IRDAI.

The Company’s basic motto is to offer a customer-centric approach to insurance. CGCL will provide a wide range of insurance products and services through website, app, and call centers. Moreover, the platform will adopt a customer-friendly payment policy too that will allow customers to pay in several ways, including through digital wallets, credit cards, net banking, and debit cards. With this tech-centric focus, CGCL aims to leverage its robust active client base of 270K to cross-sell insurance products. In H1 FY CGCL disbursed total loans amounting to Rs. 62 Bn and added 107K live clients. Further, the Company has on behalf of the partner Banks originated Car Loan of Rs. 44 Bn i.e. 39K new clients. The rapidly increasing client relationships offer CGCL a captive base to improve insurance penetration and help CGCL strengthen its fee incomeand deliver better returns to its stakeholders. The Company expects to generate a net fee income of Rs. 200 Mn from insurance cross-sell in FY 25.